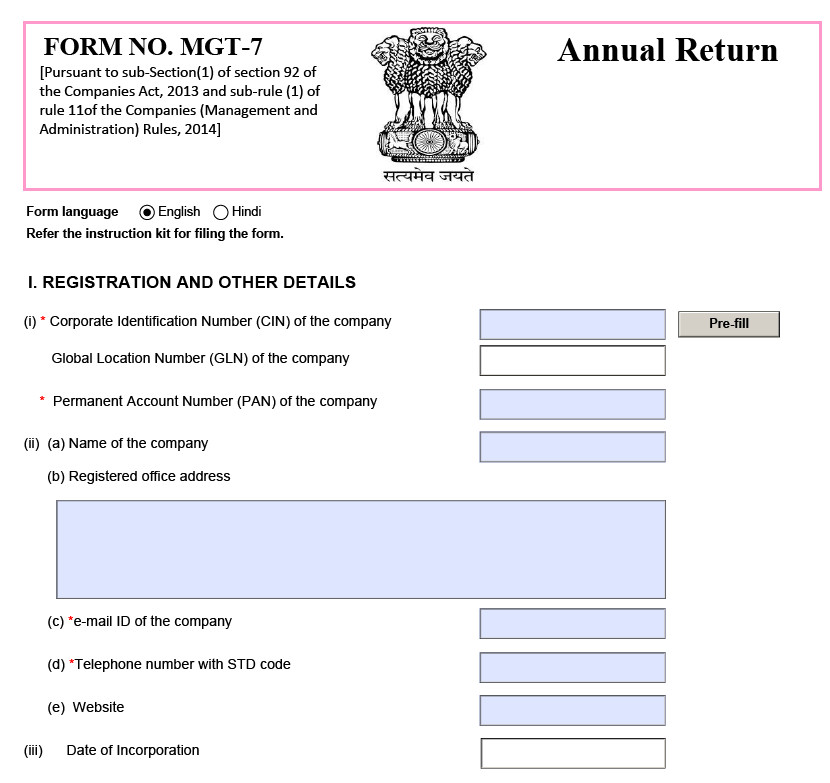

Annual Return MGT-7

MGT-7 is an electronic form used to file annual return with ROC which generally include Company’s activities, financials and governance activities.

MGT-7 is an electronic form used to file annual return with ROC which generally include Company’s activities, financials and governance activities.

Process for Filing of MGT- 7 required following steps i.e.,

Now understand every process in detail: -

Documents Deliverable: -

Time taken under this process is about 2 days

Government fees for Filing of the form MGT-7 along with the penalty

Normal fees

| Nominal share capital | Fee applicable |

| Less than 1,00,000 | 200 |

| 1,00,000 to 4,99,999 | 300 |

| 5,00,000 to 24,99,999 | 400 |

| 25,00,000 to 99,99,999 | 500 |

| 1,00,00,000 or more | 600 |

Additional fee rules

There are additional fees of 100/day if MGT-7 not filed on due date.

There are several reasons why HireYourCA stands out as your go-to partner for business registrations and compliance:

Experienced and Qualified Team: Our CAs possess extensive knowledge and expertise.

Seamless Service: We handle the entire process, keeping you informed at every step.

Cost-Effective Solutions: Competitive pricing ensures value for your money.

Client-Centric Approach: We prioritize your needs and offer personalized guidance.

Technology-Driven Platform: Our user-friendly online platform enables easy tracking and access to documents.

Transparency and Trust: We maintain complete transparency and adhere to the highest ethical standards.

All companies registered under the companies act except small and OPC i.e., public, private, listed, unlisted companies.

Now let’s Discuss about the documents need for filing of Form MGT 7A

this is a download link button