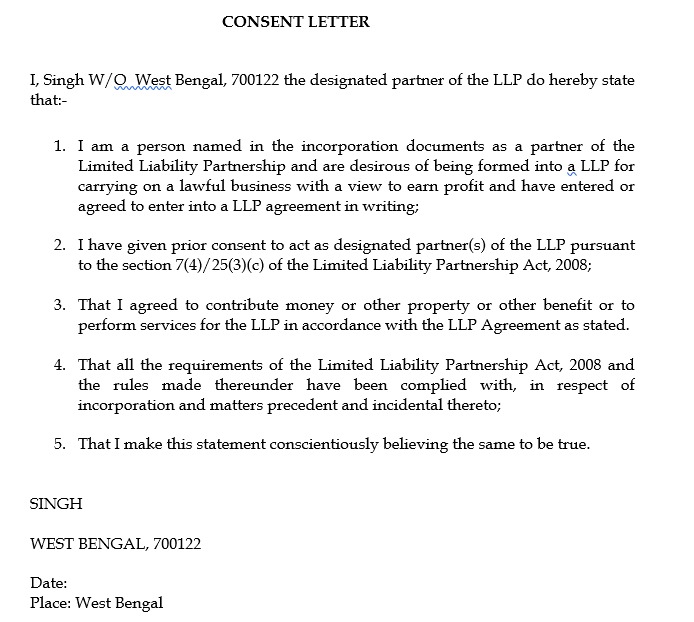

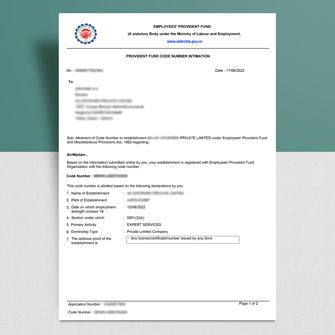

Limited Liability: Partners are not personally liable for the debts and obligation of the partnership

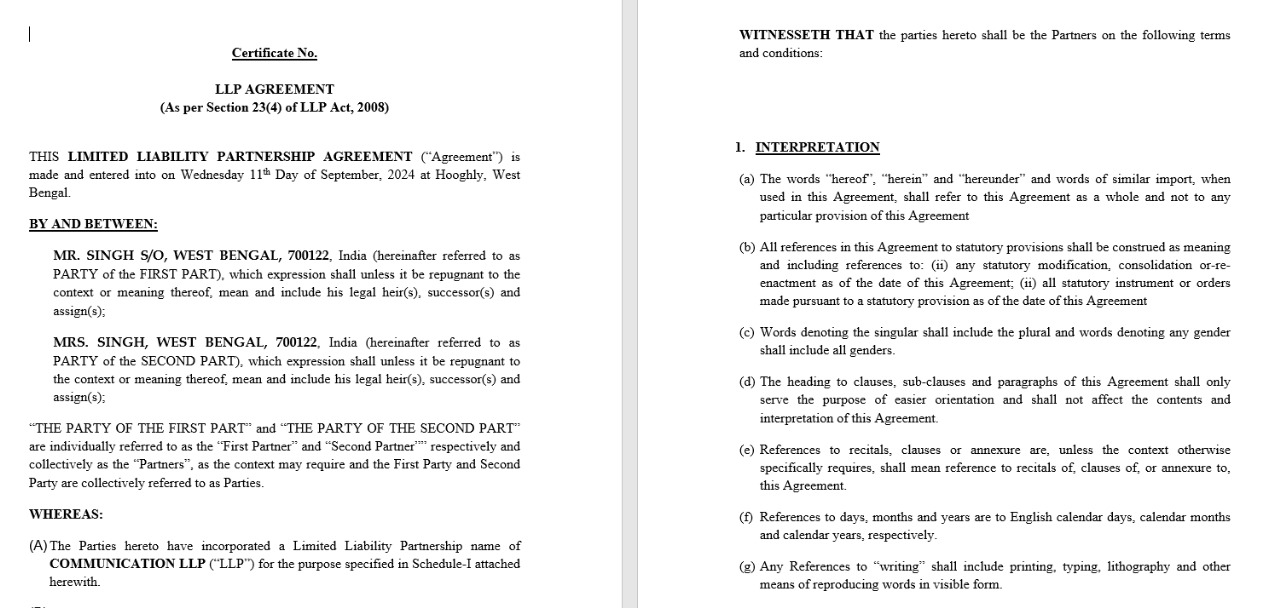

Flexibility: LLP offers a flexible structure to all the partners so that they manage business as per the requirement.

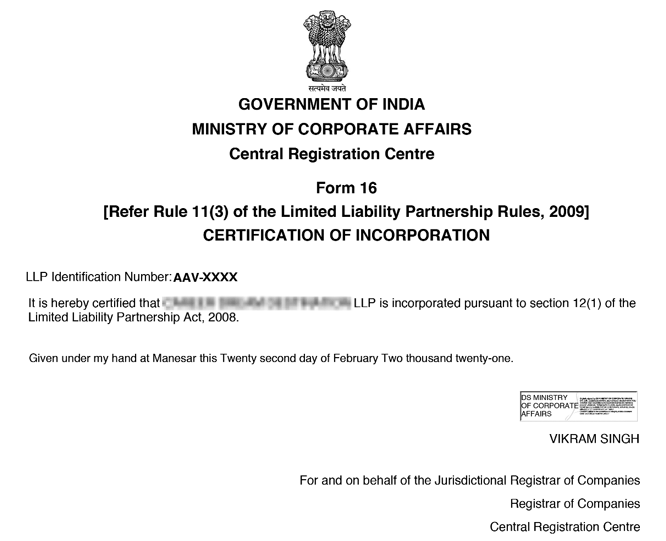

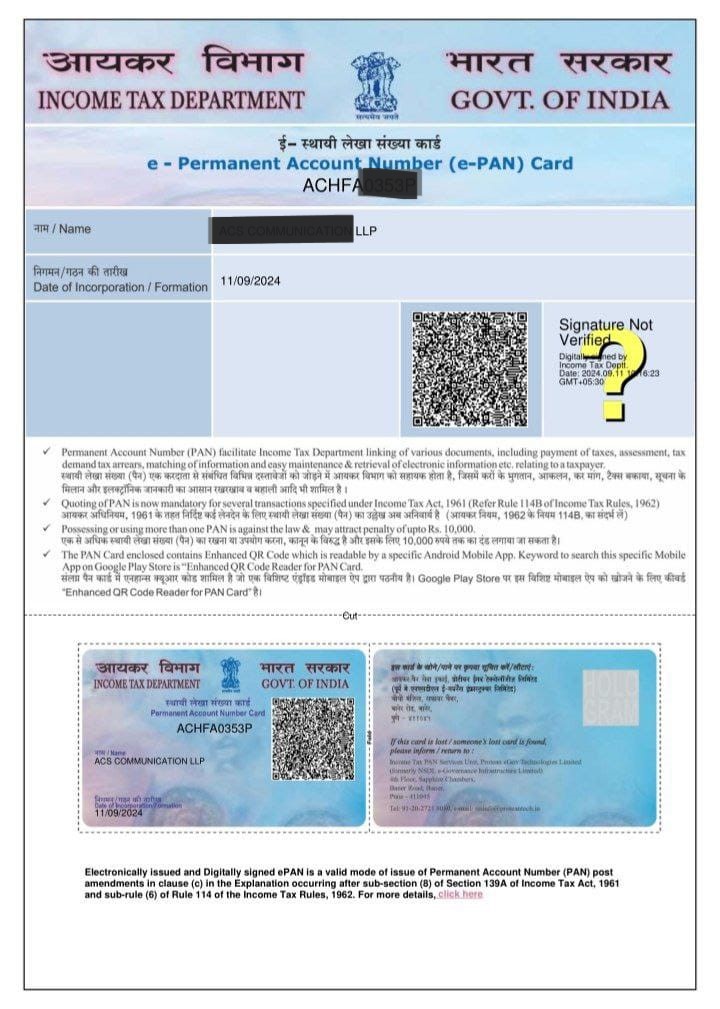

Separate Legal Entity: LLP is a separate legal entity from its partners and can buy or sell any asset or enter into any contract on the name of LLP.

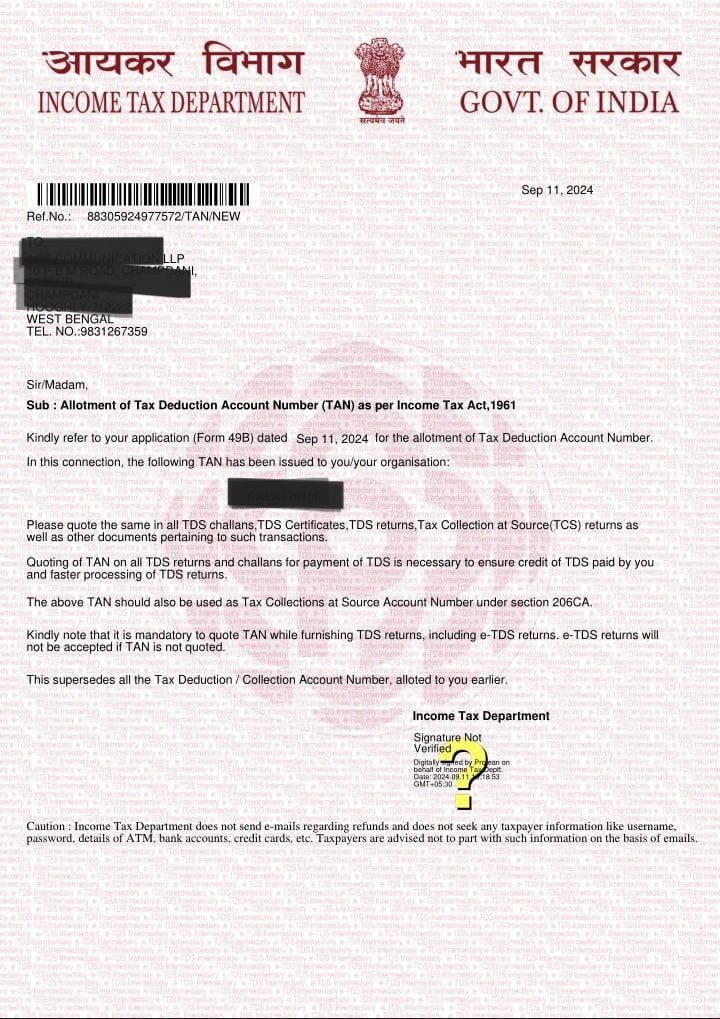

Tax Benefits: LLPs are taxed at a lower rate as compared to other entities.

More Credible: - LLP consider more credible as compared to the other partnership and the sole proprietorship.

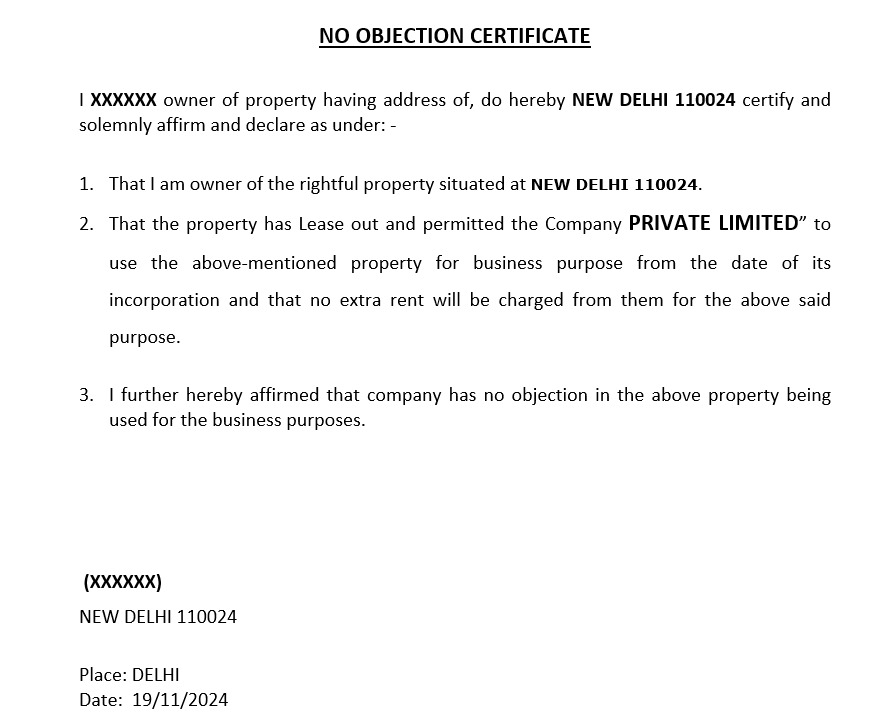

Capital Requirement: - There is no minimum capital required to form an LLP in India.

Perpetual succession: - LLP also enjoy the advantage of perpetual succession which means LLP run forever irrespective of whether designated partner may come and go.